Click to view larger

from Jeff Peterson, Truluma President/CEO

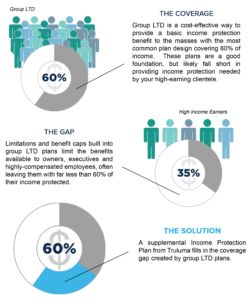

Group LTD plans are a cost-effective way to provide basic income protection benefits to the masses. The most common plan design covers 60% of income with a monthly benefit cap in the $5,000 to $10,000 range.

Unfortunately, the benefit cap built into Group LTD plans create a protection gap for many business owners, executives, and highly-compensated employees, often leaving them with far less than 60% of their income protected. For example, take an executive earning $350,000 per year that has a Group LTD benefit covering 60% of income and capped at $10,000 per month. In the event of an extended illness or injury that prevents her from working, her monthly benefit would be limited to $10,000 per month or just 34% of her income due to the benefit cap.

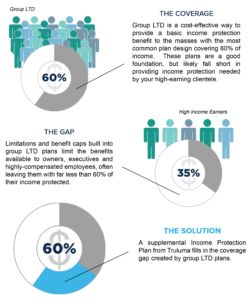

A supplemental Income Protection Plan using Individual Disability Insurance can fill the gap created by Group LTD plans. This added layer of protection covers bonuses, dividends, distribution, and other incentive income, allowing owners, executives, and highly-compensated employees to fully protect their incomes. Additionally, when designed as part of an executive benefit package, a supplemental Income Protection Plan can be granted on a guaranteed-issue basis through a streamlined, e-enrollment process.

Adequate income protection is a critical part of any benefit package. By properly combining a Group LTD plan with supplemental Individual Disability policies, employers can provide their highly-compensated employees with the coverage they need. Find more details here.